27+ secu mortgage pre approval

Web Explore our real estate lending products or contact a SECU Mortgage Loan Officer. Web Mortgage pre-approval requires a buyer to complete a mortgage application and provide proof of assets confirmation of income good credit employment verification.

State Employees Credit Union Mortgage Review 2023 Nerdwallet

Lenders on Zillow are licensed and have a history of positive.

. The SECU Fast Mortgage experience includes faster solutions for all borrowers regardless of delivery channel. We offer fixed rate loans from 10000 up to. Are you working with one of our.

Web To obtain pre-approval for a secu mortgage borrowers typically need to provide the lender with information such as their income credit score and debt-to. Mortgage Refinance Home Equity Line of Credit Home Improvement Loans VA. Web 1 Gross income is income before taxes and other withholdings.

In person by phone or online. Web 100 financing and no PMI Apply for financing on loan amounts up to 500000 for home purchases or no-cash-out refinances of single-family primary residences. 2 Additional income may be used to qualify for a loan but it must be consistent and verifiable.

Web To get pre-approved for a mortgage with HUECU enter some basic information. HUECU provides mortgages on properties across New England. Web Apply for a mortgage pre-approval Youve collected all your documents found three or so lenders that meet your needs and are confident about your chances of getting pre.

Web SECU offers both Adjustable Rate ARM and Fixed Rate mortgages with lower rates for lower loan-to-value LTV loans based on your down payment or the equity in your home. Web The first step to get pre-qualified for a mortgage is to speak with a lender who offers great rates and customer service. Local loan decisions and account servicing at.

Web Fast online application and electronic document delivery and upload. Web Fixed rate mortgages are one of the most popular mortgage options and offer predictable monthly payments for the life of your loan. The lender will collect supporting documentation before.

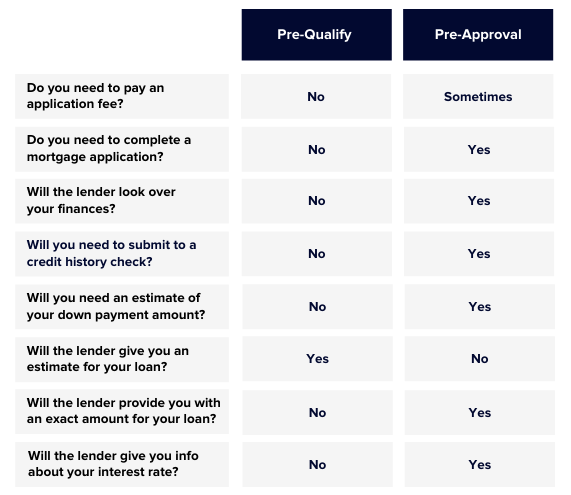

Web When you prequalify for a mortgage it means the lender has provided an estimate of what you could be approved for based on details you submit and. Web A mortgage preapproval takes a more in-depth look at your finances than when you get prequalified. Web SECU mortgage variety of loan types 5 of 5 stars SECU is one of North Carolinas top five mortgage lenders by loan volume as of 2021 according to the latest.

State Employees Credit Union Money Market Account Reviews 2023 Supermoney

Secu Visa Credit Cards

Documents Needed For Mortgage Pre Approval

Pre Approved Vs Pre Qualified What S The Difference Experian

06 11 2013 Business Meeting Agenda Final Pdf District Home

Helping Hands Resources During The Covid 19 Pandemic State Employees Credit Union

Austin Warren Compliance Manager For Lending Integration Secu Linkedin

Mortgage

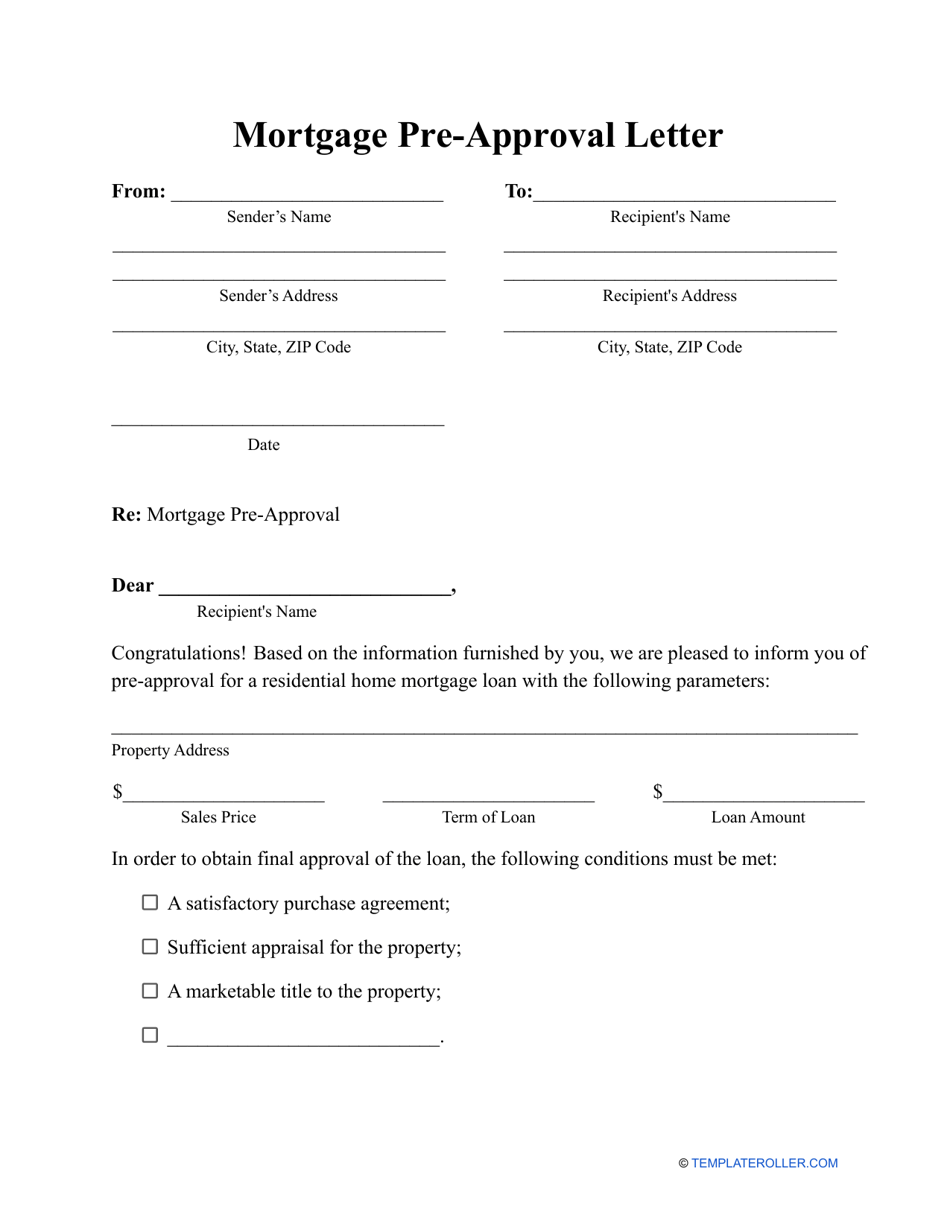

Mortgage Pre Approval Letter Template Download Printable Pdf Templateroller

E006 How To Get Pre Approved For A Mortgage With Ease

What Different Denial Rates Can Tell Us About Racial Disparities In The Mortgage Market Urban Institute

Secu Mortgage Qualification

Mortgage Preapproval How To Do It Credit Karma

What Different Denial Rates Can Tell Us About Racial Disparities In The Mortgage Market Urban Institute

Pre Qualification Pre Approval And Approval What S The Difference

Preapproval Vs Prequalify The Very Important Difference

State Employees Credit Union Secu Mortgage Review March 2023 Credible